how to file taxes if you're a nanny

If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the. How to handle the nanny tax Step 1.

How Can I Reduce My Taxes In Canada

CPA Professional Review.

. Pay Your Nannys Salary. How to file taxes as a nanny without W2. Yes you have to file.

Gifts by the IRS definition are given with the expectation of nothing of value in return. To file quarterly utilize this structure to estimate representative federal annual tax manager and worker Social Security. Easy Tax Preparation Management.

Your nanny should fill out an I-9 a federal W-4 form PDF and a state withholding form if your state collects income tax. Report Inappropriate Content. Ad Prevent Tax Liens From Being Imposed On You.

As a household employer you are required to file state unemployment tax returns typically on a. If your brother was able to control. Keeping track of the wages and filing all of the tax paperwork associated with the nanny tax can be overwhelming.

You will use this form to file your. I am a nanny how do I pay my taxes. Apply for one online.

Youll also need to file a Form W-2 Wage and Tax Statement and furnish a copy of the form to your nanny and Social Security Administration. Ad Payroll So Easy You Can Set It Up Run It Yourself. Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages.

When income tax season rolls around your employer is required to send you a Form. Publication 926 magagem linked to is important. This form will show your wages and any taxes withheld.

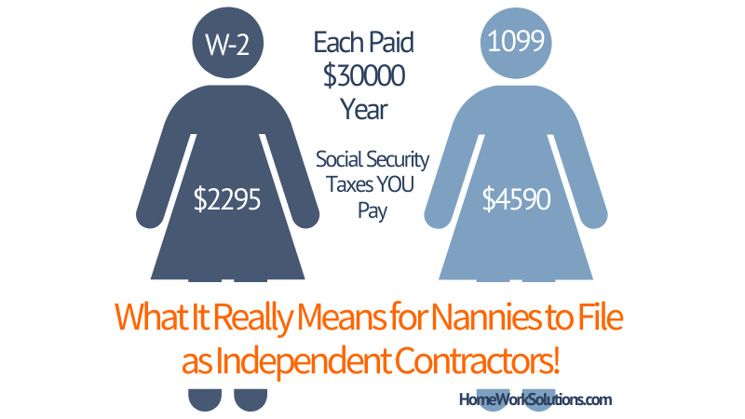

Parents will need to file Schedule H with their own federal income tax return which reports Social Security Medicare unemployment tax and any income tax withheld from their. Know youre an employee not an independent contractor. If youre considered a household employer by the IRS then you need to pay Social Security and Medicare taxes on your employee.

How to fill out Form 8829. Taxes Paid Filed - 100 Guarantee. If youre a nanny who cares for children in your employers home youre likely an employee.

Ask your household employee for a Social Security number or an Individual Taxpayer Identification Number a completed Form I-9 and a completed federal. Ad Ideal For Busy Families and Budgets. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by.

Complete a Form W-2 and give copies B C and 2. Your name address and phone number. Your share is 765 percent of their wages.

How does a nanny file taxes as an independent contractor. If you make 2400 or more from a family the family. Revealing and Filing Taxes.

That means you file taxes the same way as any other employed person. The bottom line of Schedule C on line 31 Net profit or loss will then flow to line 12 of Form 1040 Business income or loss. You may owe state unemployment taxes SUI Do not count wages if your nanny is a spouse your child under age 21 or parent.

Year-to-date information should be indicated on your final pay stub of the year. Ad Payroll So Easy You Can Set It Up Run It Yourself. Attach Form 4852 Substitute for Form W-2 Wage and Tax Statement to your return.

Hire a company or agent to prepare your taxes. What you need to do when you take on any caregiving or household job. State law requires you to provide your nanny with a written Wage Notice at the time of hire.

Maximize Your Tax Refund. Form 8829 is only one page long but it asks many long-winded questions. Your employer is required to give you a form W2 by January 31st.

Know what forms are required. At tax time youll need to file a Form W-2 reporting your household employees income earned and withholdings and Form W-3 Transmittal of Wage and Tax Statements with. If you were paid more than 1800 by one employer you should receive a W-2 as a Household Employee.

Attach Schedule C or C-E. However youll still need to pay this tax on wages. Pay state taxes and file state household employment tax returns on a regular basis.

Calculate the business area of your home. The notice must include. Taxes Paid Filed - 100 Guarantee.

For more details and exceptions for when W-2 reporting is not required see Household Employment Taxes and Nanny Tax Guide. If youre paying your household.

Free Au Pair Weekly Stipend Receipt Au Pair Working Mom Tips Tax Software

How To File Nanny Taxes For Nannies Employers Benzinga

Babysitting Tax In Canada What You Need To Know

Why Spend Countless Hours Trying To Do Your Taxes When You Could Get Kennedy Tax Accounting To Do It For You We Know When All The Fil Accounting Kennedy Job

Why You Shouldn T Celebrate That Big Tax Refund Capital Gains Tax Income Tax Return Tax Return

Day Care Center Business Plan Yenom Marketing Inc Daycare Business Plan Starting A Daycare Daycare Center

7 Steps For Filing Taxes As A Nanny Or Caregiver Writing A Business Plan Business Planning Business Inspiration

8 Tax Benefits All Work At Home Moms Should Know About Work From Home Moms Tax Refund Tax

Can A Nanny Be Self Employed Canada Cubetoronto Com

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

How Does A Nanny File Taxes As An Independent Contractor

Tax Planning Time Now Is The Ideal Time To Schedule A Tax Planning Session You Can Estimate Your I Small Business Accounting Savings Strategy Tax Organization

Here Is A Look At Irs Guidelines For Book Authors For Hobbyist Vs Pro Income Tax Tax Return Filing Taxes

Do I Have To Claim Babysitting Income In Canada Ictsd Org

Pdf Doc Free Premium Templates Receipt Template Invoice Template Statement Template